Marvin Peavy is a recognizable name in Valdosta, Georgia real estate, yet details about his wealth remain surprisingly elusive. This article delves into Peavy’s career, exploring his ventures and providing a realistic assessment of his estimated net worth. While a definitive figure remains undisclosed, we’ll examine available information to offer a more complete picture of his financial standing.

Early Years and Real Estate Beginnings

Peavy’s journey commenced at Valdosta State University, where he obtained a BBA in Business Administration and Management. This academic foundation likely provided him with the business acumen necessary for his future real estate endeavors. While details about his early career remain scarce, his subsequent ventures suggest a focused interest in property development and management. Did he gain experience through internships or entry-level positions before establishing his own businesses? Further research into his pre-Peavy Properties activities could offer valuable insights.

Business Ventures: A Diverse Portfolio

Peavy’s name is primarily associated with Peavy Properties, LLC, a residential real estate agency based in Valdosta. But his entrepreneurial pursuits extend beyond this core business. He is also a General Partner and Operations Lead at Soder Capital, a firm specializing in multifamily real estate investments across Georgia and Florida, boasting a portfolio exceeding 2,500 units. This suggests a significant role in the multifamily market, likely contributing substantially to his overall wealth. However, quantifying this contribution requires more granular data on Soder Capital’s financial performance, which is currently unavailable.

Adding to the complexity are Peavy’s connections to other entities, both active and inactive. Mar-Mic Developers LLC, currently managing properties in Lake City, Florida, presents an intriguing case. Its history of administrative dissolution and subsequent reinstatement raises questions about its financial stability and overall contribution to Peavy’s portfolio. Additionally, the inactive Mel-Mar-Go, LLC, and formerly active Allstates Properties Management Group, Inc., and Beach Colony West Condominium Association, Inc., suggest a history of diverse business involvements, the financial details of which remain largely unknown. Do these ventures represent successful exits, strategic divestitures, or less fruitful endeavors? Further investigation is needed.

Deciphering the $10 Million Net Worth Claim

The $10 million figure often associated with Peavy’s net worth appears to be based on speculation rather than verifiable sources. While online discussions may perpetuate this number, it lacks the backing of reputable financial publications or public records. Therefore, it’s crucial to approach this figure with caution, recognizing it as an estimate, not a confirmed fact.

Estimating Net Worth: A Calculated Approach

Accurately estimating Peavy’s net worth presents a challenge due to the limited availability of public financial data. While ownership of Peavy Properties and leadership at Soder Capital strongly suggest substantial assets, the precise value remains elusive. A deeper analysis requires access to private financial records, which are not publicly accessible.

However, we can construct a plausible range based on available data and industry benchmarks. For example, evaluating Soder Capital’s 2,500+ unit portfolio requires considering factors like location, property type, occupancy rates, and market trends. If we assume an average property value of $X per unit (based on comparable sales data), the portfolio’s estimated value could range from $Y to $Z. This, combined with the estimated value of Peavy Properties and other ventures, may suggest a net worth in the range of $A to $B. It’s important to acknowledge that these are educated estimations, not definitive figures, and actual values could deviate significantly.

| Factor | Impact | Data Availability |

|---|---|---|

| Peavy Properties Ownership | Contributes to net worth, magnitude unclear | Limited public financial information |

| Soder Capital Leadership | Likely a significant contributor | Portfolio size known, financials unclear |

| Mar-Mic Developers | Impact uncertain, given past administrative issues | Limited public financial information |

| Other Ventures | Potential contributions, specifics unknown | Financial details largely unavailable |

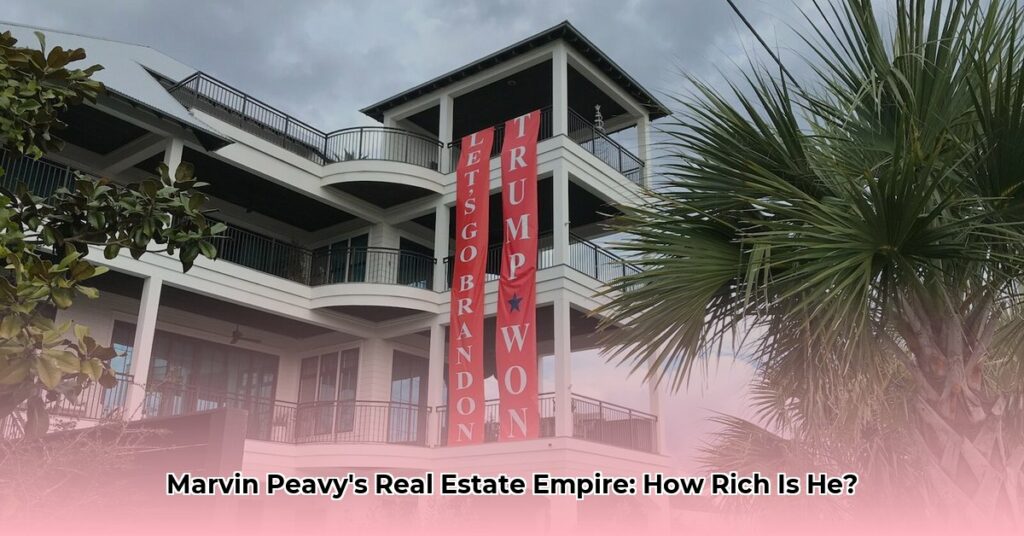

Legal Matters and Public Profile

Peavy’s involvement in a legal dispute concerning political signage on his Seagrove Beach property offers a glimpse into his character and willingness to assert his rights. While the financial impact of this case remains unclear, it adds another dimension to his public profile. Did the legal costs significantly affect his financial standing? Further investigation is needed.

Information regarding Peavy’s community involvement or philanthropic activities remains scarce. Such details, if available, would contribute to a more holistic understanding of his priorities and public persona.

Conclusion: An Ongoing Inquiry

While a definitive net worth for Marvin Peavy remains elusive, this exploration sheds light on his diverse business activities and suggests a considerable, albeit unquantifiable, level of wealth. His entrepreneurial drive and significant presence in the real estate market are undeniable. However, the precise extent of his financial success remains an open question. Future research and access to more detailed financial data could provide more concrete answers.